- Get link

- X

- Other Apps

If the credit card company is willing to entertain the idea of a debt settlement then the odds are high that they will want to make one of the following arrangements. Negotiating credit card debt You may be able to call your card issuers to negotiate the terms of your debt.

6 Easy Tips For Paying Down Your Credit Card Debt

6 Easy Tips For Paying Down Your Credit Card Debt

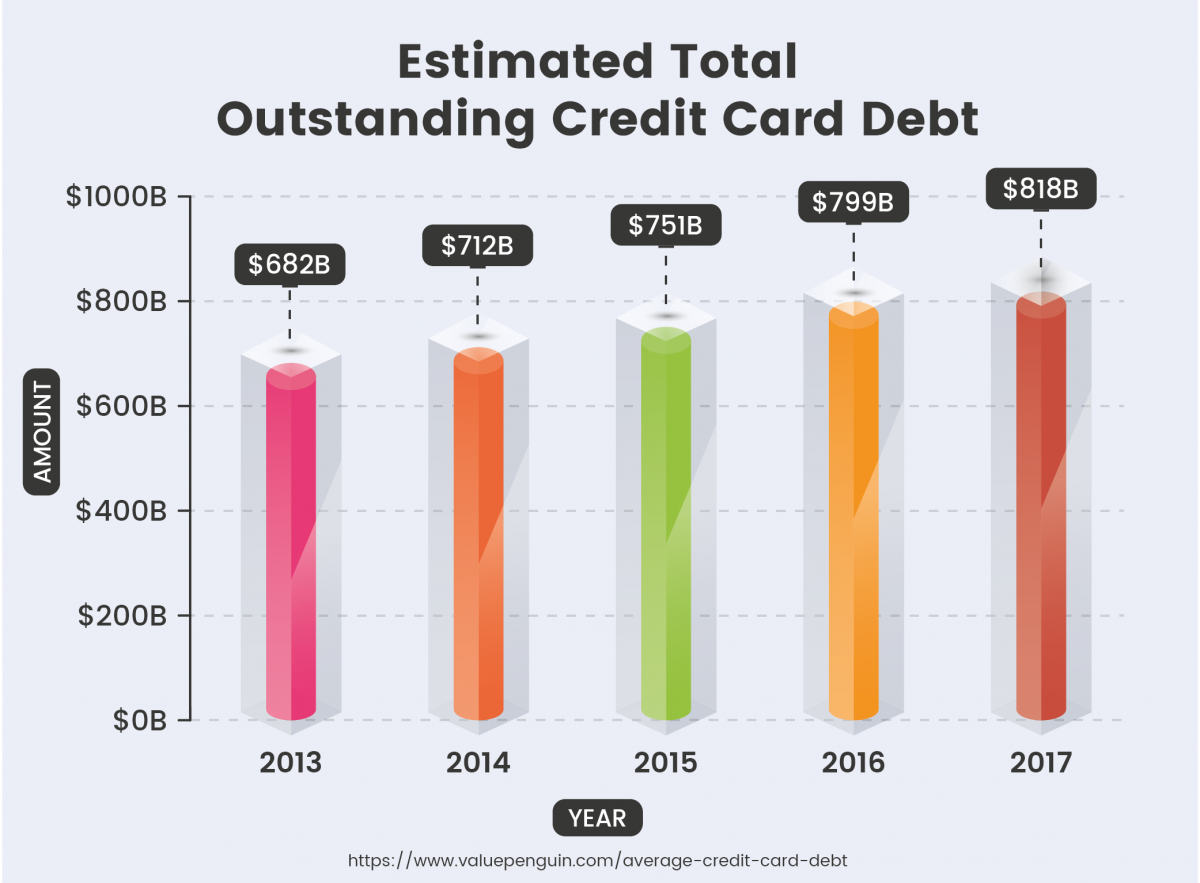

However fast-forward 10 years and in 2020 credit card debt is again at an all-time high at 930 billionDespite this unemployment before the onslaught of the COVID-19 pandemic was at a 50-year low of 36Credit card debt isnt a new problem and the resilience of the American economy even after suffering through depressions and recessions indicate that unless something cataclysmically.

What to do with credit card debt. Paid more in interest and charges than the amount of debt youve paid off. Pull your free credit report and sign up for a free credit monitoring service. Been paying off a debt on your card for 18 months or more.

Lump-Sum Payment Agreement In this instance you negotiate with the credit card company to pay a lump sum of money that is less than what you owe. Put it in the bottom of a desk drawer at home. The Fair Debt Collection Practices Act requires debt collectors to provide a validation letter.

For example lets say you have a credit limit of 9000 but with interest fees and penalties your current balance is 12000. At this point it is best to not freak out and understand that its time to face your debt. During that process youll cover important topics such as your will medical directives final wishes and more.

If ballooning credit card debt keeps you up at night there are steps you can take to get your balance under control. Instead of dealing directly with credit card issuers you pay the debt settlement company an agreed-upon amount every month and the company disburses payment to your creditor after reaching a settlement agreement. The financial expert Dave Ramsey invented the snowball method.

Then youve got to deal with your debt burden. One is called snowballing your debts and the other is called debt stacking. The average debt among households that carry debt is about 9000 and richer indebted households owe more than poorer ones.

If you are sued for credit card debt your first step is to verify that the debt is actually yours. If you have credit card debt its wise to plan aheadyou can make things easier on everybody at the time of your death. Then move on to the next debt and do the same thing.

In some cases credit card companies are open to lowering interest rates or monthly. If you are generally committed to the idea of getting rid of your credit card debts their are two methods available. Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are community property states and Alaska gives spouses the option to make their property community.

Put it up on a high shelf. Finally consider turning to a nonprofit credit counseling agency like InCharge Debt Solutions which may be able to help consolidate credit card debt lower interest rates and reduce your monthly payment with a debt management plan. This allows you to build up stamina with small wins.

Estate planning is the process of planning for death and its a good idea for everybodyrich or poor. Some people looking to settle turn to a debt settlement company which negotiates on your behalf with your credit card companies and acts as an intermediary. Your credit card company has 30 days to confirm receipt of your notice as well as two complete billing cycles but no more than 90 days to investigate and respond to you.

The other 3000 you owe will be forgiven. If you think theres been an error on your credit card statement send your credit card company a billing error notice that disputes the charge. The debt is basically considered a loss by the original lender or creditor.

Theyll write to you after youve had the debt for 18 months 27 months and 36 months. When you are served summons for a debt someone will usually come to your house or work ask you for your name and present you with a civil summons. You may be able to negotiate so that you pay just three installments of 3000.

Hand the credit card debt off to the executor of the estate that is the person tasked with settling the persons financial affairs and let him or her deal with the creditors. You might get a letter from your credit card company saying youre in persistent debt if youve. If you find yourself in a hole stop digging.

The popular debt snowball method recommends wiping out your smallest credit card debt first by increasing your payment on that card while paying the minimum on the rest of your debt until that first debt is paid off. That means not using your credit card. If you live in a community property state you may have to pay your spouses credit card debts after their death even if you were only an authorized user or the credit card was solely in their name.

Sometimes your credit card issuer will reduce your debt to the principal you owe.

Signs You Have Too Much Credit Card Debt

Signs You Have Too Much Credit Card Debt

Consolidate Credit Card Debt With A Personal Loan Earnest

Consolidate Credit Card Debt With A Personal Loan Earnest

How To Escape Your Growing Credit Card Debt

How To Escape Your Growing Credit Card Debt

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

What A Relief Get Out Of Your Credit Card Debt With These Tips Zing Blog By Quicken Loans

How To Deal With Credit Card Debt Debtconsolidation

How To Deal With Credit Card Debt Debtconsolidation

How To Get Out Of Credit Card Debt Real Simple

How To Get Out Of Credit Card Debt Real Simple

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

How To Pay Off Credit Card Debt Faster

How To Pay Off Credit Card Debt Faster

How Long Will It Take To Pay Off Credit Card Debt Chart

:max_bytes(150000):strip_icc()/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg) Ways To Avoid Credit Card Debt

Ways To Avoid Credit Card Debt

5 Ways To Reduce Credit Card Debt

How To Pay Off Credit Card Debt Ramseysolutions Com

How To Pay Off Credit Card Debt Ramseysolutions Com

Comments

Post a Comment